If a tax is levied on the sellers of flour, then

a. buyers will bear the entire burden of the tax.

b. sellers will bear the entire burden of the tax.

c. buyers and sellers will share the burden of the tax.

d. the government will bear the entire burden of the tax.

c

You might also like to view...

When producers would have been willing to accept lower prices at various quantities produced than the market clearing price, the differences are called

A) producer surplus. B) monopoly profits. C) opportunity cost. D) deadweight loss.

When variable A rises by 10 units, variable B rises by 15 units. The slope of the line describing this relationship is

a. always 2/3. b. either 2/3 or 1.5, depending on which variable goes on which axis of the graph. c. either 1.5 or ?1.5, depending on which variable goes on which axis. d. always ?1.5.

Why is plowback the overwhelming favorite among choices of sources of funds for financing corporate investment?

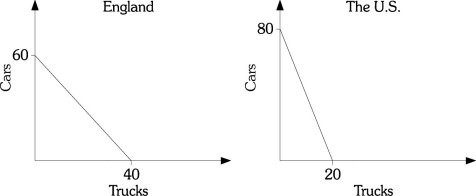

Refer to the information provided in Figure 20.2 below to answer the question(s) that follow. Figure 20.2Refer to Figure 20.2. The opportunity cost of 1 ________ is 0.25 ________ in the United States and 0.67 ________ in England.

Figure 20.2Refer to Figure 20.2. The opportunity cost of 1 ________ is 0.25 ________ in the United States and 0.67 ________ in England.

A. truck; car; car B. car; car; truck C. truck; truck; car D. car; truck; truck