Assume the production of a good gives rise to external benefits. The government may increase efficiency by

A) subsidizing consumption of the good.

B) requiring all producers of the good to be licensed.

C) taxing production of the good.

D) imposing taxes on the good.

Answer: A

You might also like to view...

A monopolistically competitive firm prices its product using the markup pricing formula P = 1.25MC, where MC is the marginal cost of producing an additional unit

Suppose the demand for the firm's product is given by Q = 2000 - 0.1P, so the revenue from selling Q units of the product is PQ = 2000P - 0.1P2. (a) If the marginal cost of producing each unit of the product is $10,000, calculate the price of the product, the quantity produced, and the firm's revenues, costs, and profits. (b) Now suppose the marginal cost rises to $11,000. The firm can keep the price of the product unchanged, or it can change the product's price at a total cost of $700,000. Calculate the price, quantity, revenues, costs, and profits as in part (a) both for changing the price and leaving the price unchanged. Should the firm change the price of its product?

The benefits principle states that the users of a service should pay for that service.

Answer the following statement true (T) or false (F)

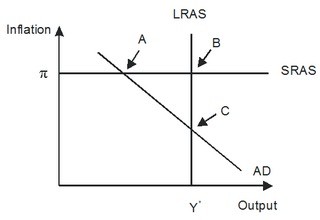

Refer to the given figure. In response to gradually falling inflation, this economy will eventually move from its short-run equilibrium to its long-run equilibrium. Graphically, this would be seen as:

In response to gradually falling inflation, this economy will eventually move from its short-run equilibrium to its long-run equilibrium. Graphically, this would be seen as:

A. aggregate demand shifting rightward. B. short-run aggregate supply shifting downward. C. aggregate demand shifting leftward. D. long-run aggregate supply shifting leftward.

The legislation passed in 2010 that was intended to reform regulation of the financial system was the

A) Wall Street Reform and Consumer Protection Act. B) Sarbanes-Oxley Act. C) Glass-Steagall Act. D) Federal National Mortgage Act.