Graham Corporation's budgeted production schedule, by quarters, for the coming year is as follows:Quarter 1 = 22,500 unitsQuarter 2 = 19,000 unitsQuarter 3 = 17,000 unitsQuarter 4 = 24,000 unitsEach unit of product requires three pounds of direct material. The company's policy is to begin each quarter with 30% of that quarter's direct materials production requirements.Graham expects to have 50,000 pounds of direct materials on hand at the beginning of Quarter 1.What would be Graham's budgeted direct materials purchases (in pounds) for the first quarter?

What will be an ideal response?

34,600 pounds

1. Desired ending inventory, Quarter 1 = [(19,000 units × 3 lbs./unit) × 0.30] = 17,100 lbs.

2. Lbs. of direct materials needed for Quarter 1 production = 22,500 units × 3 lbs./unit = 67,500 lbs.

3. Required purchases (pounds), Quarter 1 = Materials required for production + Desired ending inventory ? Beginning inventory = 67,500 lbs. + 17,100 lbs. ? 50,000 lbs. = 34,600 lbs.

You might also like to view...

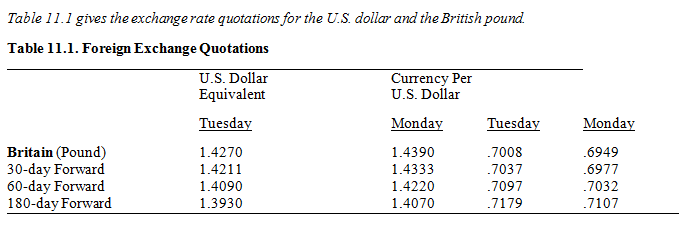

Consider Table 11.1. If one were to buy pounds for immediate delivery, on Tuesday the dollar cost of each pound would be

a. $0.7008.

b. $0.7037.

c. $1.4211.

d. $1.4270.

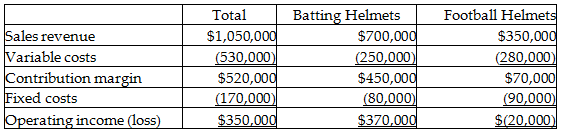

If $50,000 of fixed costs will be eliminated by dropping the football helmets line, how will dropping football helmets affect operating income of the company?

Crash Sports, Inc. has two product lines—batting helmets and football helmets. The income statement data for the most recent year is as follows:

A) Operating income will increase by $50,000.

B) Operating income will increase by $70,000.

C) Operating income will decrease by $90,000.

D) Operating income will decrease by $20,000.

The first step in creating the master budget is the creation of the:

A) production budget. B) direct labor budget. C) cash budget. D) sales budget. E) budgeted income statement.

Which of the following is one of the broad categories for martial property?

a. Quasi-community property b. Separate property c. Community property d. All of the above