A firm that produces chemical solvents creates some air pollution because of the emissions from its manufacturing facilities. A tax is imposed on the firm, equal to the costs of environmental damage caused by a unit of the emissions

What is the result? A) The quantity of chemical solvents produced now will be the efficient amount.

B) Demand for the chemical solvents will increase.

C) Demand for the chemical solvents will decrease.

D) Consumers of the chemical solvents will be willing to pay the full amount of the tax, and so the quantity produced will be unaffected.

A

You might also like to view...

The full minutes of FOMC meetings are

A) released to the public immediately after the meeting. B) released to the public only after the next meeting. C) never released to the public. D) always geared towards controlling inflation.

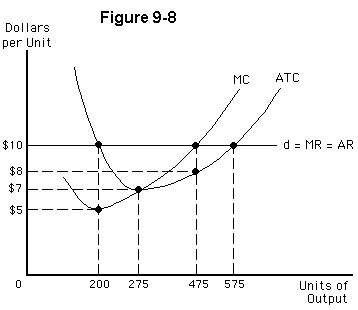

In short-run equilibrium, the perfectly competitive firm of Figure 9-8 will earn a total economic profit of

a.

zero

b.

$950

c.

$825

d.

$1,425

e.

$575

If the aggregate supply curve shifts to the right, the ________ curve shifts to the ________.

A. aggregate demand; left B. aggregate demand; right C. Phillips; left D. Phillips; right

A weakness in the concept of GDP is that it ignores income distribution.

Answer the following statement true (T) or false (F)