Why did observers at first believe that the damage from the impending subprime mortgage crisis would be too small to cause a recession?

For two reasons, observers at first thought that the damage from the impending subprime mortgage crisis would be too small to cause a recession. The first mistake was that most people grossly underestimated the scale of the subprime mortgage market. In fact, volume had soared during the late stages of the bubble.

The second reason requires explanation of the concept of securitization. A bank which has made several high risk loans is in danger of bankruptcy if the loans default. An investment bank, acting as a securitizer, pays the bank at risk a sum of money for its mortgages, packages them together with supposedly less risky loans from around the country, so that if one market goes bad, the market in other geographical areas will have a moderating effect on the portfolio. The securitizing investment bank sells shares in this portfolio to thousands of investors all over the world, so that no one bank is left holding all the risk. That was the theory.

In practice, prices did fall all across the country, although it was worse in some areas than others, Also, the securities formed from these risky mortgages were not as widely distributed as had been thought. Among those left holding the bag were Bear Stearns, Lehman Brothers, Merrill Lynch, Wachovia, Citigroup, Bank of America and others. When the panic hit, they tried to sell their portfolios, which reduced prices further.

You might also like to view...

Which of the following groups has had declining labor force participation over the past 30 years?

A. Women B. Men C. Teenagers D. Americans

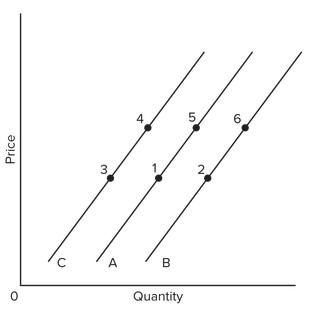

Use the figure below to answer the following question. An increase in supply would best be reflected by a change from

An increase in supply would best be reflected by a change from

A. point 2 to point 5. B. point 1 to point 3. C. point 1 to point 2. D. point 3 to point 4.

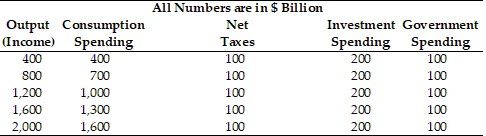

Refer to the information provided in Table 24.1 below to answer the question(s) that follow.Table 24.1 Refer to Table 24.1. At the equilibrium level of income, leakages equal ________ billion.

Refer to Table 24.1. At the equilibrium level of income, leakages equal ________ billion.

A. $0 B. $100 C. $200 D. $300

Refer to Scenario 9.9 below to answer the question(s) that follow. SCENARIO 9.9: Sponsors invest $250,000 in a new greeting card business on the promise that they will earn a return of 10% per year on their investment. The business sells 52,000 greeting cards per year. The fixed costs for the business include the return to investors and $79,000 in other fixed costs. Variable costs consist of wages ($1,000 per week) plus materials, electricity, etc. ($3,000 per week). The business is open 52 weeks per year.Refer to Scenario 9.9. The annual fixed costs for the business sum to

A. $25,000. B. $79,000. C. $104,000. D. $208,000.