According to purchasing power parity, which of the following is FALSE about an overvalued dollar compared to the Japanese yen?

A) U.S. merchants would be motivated to import more Japanese goods.

B) Japanese merchants would tend to export more to the United States.

C) Prices in the United States would tend to fall.

D) Over the long term, the exchange rate would fall.

E) Prices in Japan would tend to rise.

D

You might also like to view...

All of the following conditions, except one, must exist in order for a firm to successfully practice price discrimination. Which is the exception?

a. The firm must be a price taker. b. The firm must be able to identify which customers are willing to pay more. c. The firm must be able to prevent the resale of its output by low-price customers to high-price customers. d. The firm must be able to charge higher prices to some customers without losing their business. e. The firm must be a price setter.

In the short run, monopolistically competitive firms will maximize profits by:

A. playing strategic games like oligopolists. B. acting like monopolists. C. acting like perfectly competitive firms. D. None of these statements is true.

Explain and show graphically how an increase in incomes in the United States will affect equilibrium in the foreign exchange market?

What will be an ideal response?

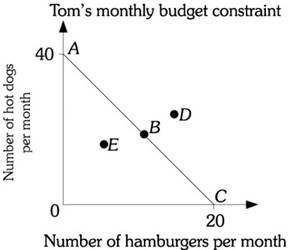

Refer to the information provided in Figure 6.1 below to answer the question(s) that follow. Figure 6.1Refer to Figure 6.1. Assume Tom's budget constraint is AC. At which point does Tom consume only hamburgers?

Figure 6.1Refer to Figure 6.1. Assume Tom's budget constraint is AC. At which point does Tom consume only hamburgers?

A. A B. B C. C D. D