If the Fed buys a $100,000 government security from a bank when the desired reserve ratio is 10 percent and the currency drain ratio is 50 percent, the bank can loan a maximum of

A) $90,000. B) $100,000. C) $60,000. D) $40,000. E) $50,000.

A

You might also like to view...

Suppose the market demand curve for a Bertrand duopoly is downward sloping. What happens to the Nash equilibrium price and market quantity if the constant marginal cost declines?

A) Price and quantity decline B) Price increases and quantity declines C) Price decreases and quantity increases D) Price and quantity increase

One fundamental idea in macroeconomics about inflation is:

A. if all wages rise, then inflation doesn't really affect anyone's purchasing power. B. when all prices rise, inflation occurs and everyone is worse off. C. keeping prices constant is the only way to ensure increasing purchasing power over time. D. if all prices decline, the purchasing power of everyone declines.

The deregulation of the banking industry, unintentionally, but eventually

a. created a boom for savings and loans that lasted a full decade b. had no dramatic effect on savings and loans but upset the stability of the banking system for well over a decade c. caused many savings and loans to go bankrupt within a few years d. caused many savings and loans to merge with other banks, which resulted in a surge in interest rates e. had no effect on the interest rates that savings and loans charged but it did affect the extent of loans, which more than doubled in a few years

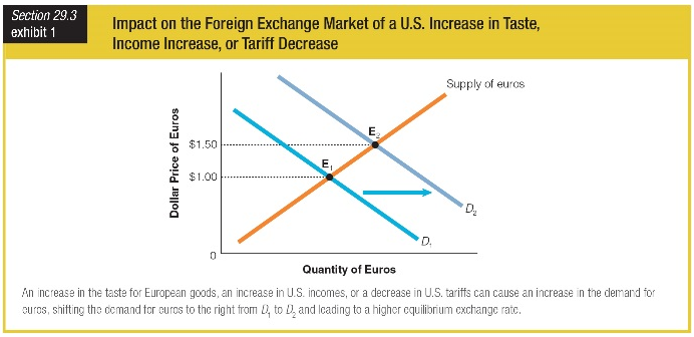

What is the impact on the foreign exchange rate?

a. The euro exchange rate changes from $1.50 per euro to $1.00 per euro.

b. The dollar appreciates in value from $1.00 to $1.50.

c. The euro depreciates in value from $1.50 per euro to $1.00 per euro.

d. The dollar price of euros increases from $1.00 to $1.50.