Suppose we want to choose capacity for a plant that will produce a new drug. In particular, we want to choose the capacity that maximizes discounted expected profit over the next 10 years. We have the following information:

· Demand for the drug is expected to be normally distributed ˜ Normal (50,000, 12,000).· A unit of capacity costs $16 to build.· The number of units produced will equal the demand, up to capacity limits.· The revenue per unit is $3.70 and the cost per unit is $0.20 (variable cost).· The maintenance cost per unit of capacity is $0.40 (fixed cost).· The discount rate is 10%.

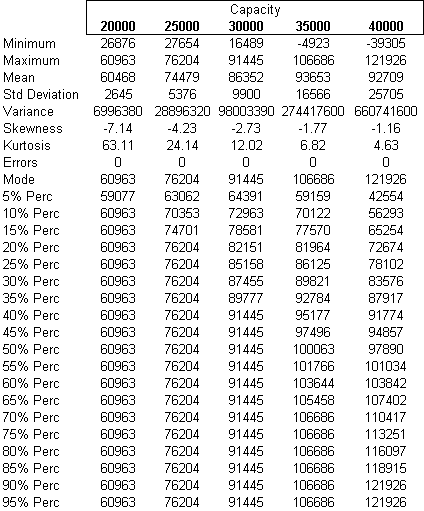

Perform a simulation assuming the plant will be designed to meet the expected demand. Use RISKSIMTABLE with a range of possible values to help the firm decide what the plant capacity should be.

What will be an ideal response?

?

?

Simulation 4 (Q=35,000 units) yields the largest mean NPV of $93,653.

?

You might also like to view...

Inventory may become obsolete because of technological advances even though there are no signs of physical wear

a. True b. False Indicate whether the statement is true or false

It is okay for an employee not to have a job description as long as both the manager and the employee know what is expected of the employee.

Answer the following statement true (T) or false (F)

Which of the following is referred to as the process by which individuals stimulate meaning in the minds of other individuals by means of verbal or nonverbal messages in the context of a formal organization?

A. perception B. conflict C. organizational communication D. interaction

Describe the reasons for increasing business globalization.

What will be an ideal response?