The U.S. tax and transfer study done by economists Chamberlain and Prante of the Tax Foundation note that households in the top income quintile received about:

A. 75 cents in government spending for every dollar they paid in taxes

B. 60 cents in government spending for every dollar they paid in taxes

C. 40 cents in government spending for every dollar they paid in taxes

D. 20 cents in government spending for every dollar they paid in taxes

C. 40 cents in government spending for every dollar they paid in taxes

You might also like to view...

Do firms in perfect competition advertise their products? Why or why not?

What will be an ideal response?

The increase in living standards of American workers over the past century is primarily due to

a. the success of labor unions. b. minimum-wage laws. c. improvements in productivity. d. None of the above are correct.

Refer to the information provided in Figure 12.1 below to answer the question(s) that follow.  Figure 12.1 Refer to Figure 12.1. The firm is

Figure 12.1 Refer to Figure 12.1. The firm is

A. less efficient when it produces at point A than at point B. B. equally efficient when it produces at points A and B. C. less efficient when it produces at point B than at point A. D. producing at least possible cost anywhere along the given ATC curve.

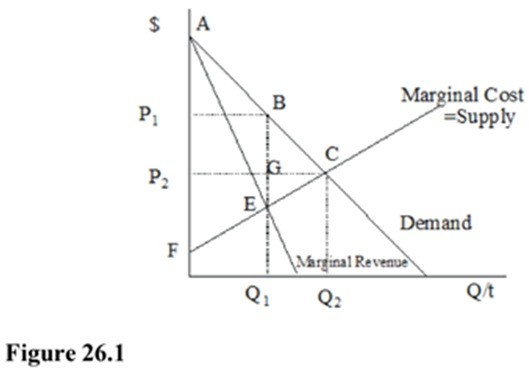

In Figure 26.1, the price under monopoly is

A. A. B. F. C. P2. D. P1.