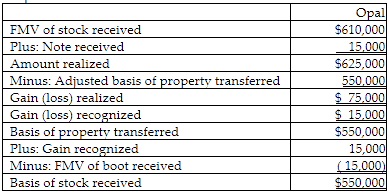

Individuals Opal and Ben form OB Corporation. Opal transfers land and a building with a $550,000 adjusted basis and a $625,000 FMV in exchange for 50% of the stock of the OB Corporation worth $610,000 and a $15,000 note. Ben transfers cash of $625,000 for 50% of the stock worth $610,000 and a note of the OB Corporation valued at $15,000. Opal's basis in the stock received is

A) $550,000.

B) $560,000.

C) $610,000.

D) $625,000.

A) $550,000.

You might also like to view...

When considering the Sapir–Whorf hypothesis, the notion that language shapes thinking is known as which of the following?

A. relativism B. linguistic determinism C. linguistic relativity D. literary critique

According to Banerjee, a socially responsible firm should offer:

a. Provisions for stakeholders legally to challenge corporate decisions and legal aid mechanisms to provide public funds to support such challenges b. Community rights to resources, including indigenous people’s rights over common property such as forests, fisheries and minerals c. Veto rights over developmental projects and against displacement d. All of the above

Security is not a major issue associated with wireless computing

Indicate whether the statement is true or false

The future value of a $10,000 annuity due deposited at 12 percent compounded annually for each of the next 5 years is ________.

A) $36,050 B) $63,528 C) $40,376 D) $71,152