The capital budgeting director of Sparrow Corporation is evaluating a project which costs $200,000, is expected to last for 10 years and produce after-tax cash flows, including depreciation, of $44,503 per year

If the firm's cost of capital is 14% and its tax rate is 40%, what is the projected IRR?

A) 8%

B) 14%

C) 18%

D) -5%

E) 12%

C

You might also like to view...

If a firm operates at less then full capacity then price _______________________ are not likely

Fill in the blank(s) with correct word

A cost that will not be affected by later decisions is termed a(n):

A) historical cost B) differential cost C) sunk cost D) replacement cost

Upon review of Roepers's statement of cash flows, the following was noted: Cash flows from operating activities $ 50,000 Cash flows from investing activities 80,000 Cash flows from financing activities (130,000) From this information, the most likely explanation is that Roeper is:

A) using cash from operations and selling long-term assets to pay back debt. B) using cash from operations and borrowing to purchase long-term assets. C) using its profits to expand growth. D) using cash from investors to provide for operations.

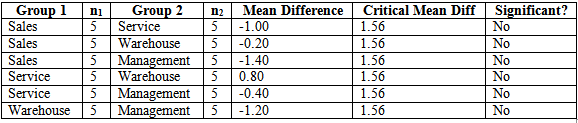

Which groups are significantly different from one another?