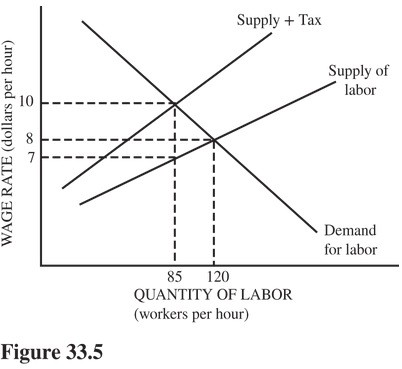

Refer to the labor market in Figure 33.5. Suppose that the government imposes a payroll tax on employers in this market. How much of the tax burden will the employers actually pay?

Refer to the labor market in Figure 33.5. Suppose that the government imposes a payroll tax on employers in this market. How much of the tax burden will the employers actually pay?

A. $8 - $7 = $1 per hour.

B. $10 - $7 = $3 per hour.

C. $10 - $8 = $2 per hour.

D. None. The employers will pass the entire burden onto the workers.

Answer: C

You might also like to view...

According to new classical economists, if a decrease in aggregate demand is correctly anticipated, the short-run aggregate supply curve will shift __________ at the same time the AD curve shifts _________ so that there will be no change in Real GDP

A) rightward; rightward B) leftward; rightward C) leftward; rightward D) rightward; leftward E) none of the above

Which of the following is part of the M1 definition of money?

a. stocks b. savings deposits c. time deposits d. demand deposits

If a country has a balance of payments deficit and wishes to maintain the fixed value of its currency, it will generally

A. sell its own currency for foreign currencies. B. buy its own currency with foreign reserves. C. decrease taxes to increase domestic disposable income. D. increase the money supply to keep interest rates down.

The demand for Ben & Jerry's ice cream will likely be ________ the demand for dessert.

A. less price elastic than B. more price elastic than C. equally price elastic as D. indeterminate from the given information