Using aggregate demand and aggregate supply, explain what happens in the short run if the Federal Reserve raises interest rates in the economy. Be sure to detail what happens to aggregate demand, the price level, the level of GDP, and unemployment

Assume that the economy is at full employment before the interest rate increase.

An increase in the interest rate will cause aggregate demand to decline. Interest costs are part of the cost of borrowing and as they rise, both firms and households will cut back on spending. This shifts the aggregate demand curve to the left. This lowers equilibrium GDP below potential GDP. As production falls for many firms, they begin to lay off workers, and unemployment rises. The declining demand also lowers the price level. The economy is in recession.

You might also like to view...

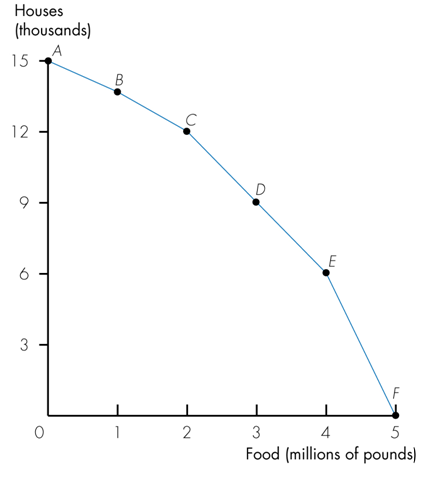

Refer to the following figure. Which of the following production possibilities would result in the greatest rate of economic growth over time?

a. Point B

b. Point C

c. Point D

d. Point E

The entire sequence of a decline in aggregate economic activity followed by recovery, measured from peak to peak or trough to trough is a

A) long-run trend. B) potential output path. C) business cycle. D) recurrent comovement.

The assumption of completeness means that

A) the consumer can rank all possible consumption bundles. B) more of a good is always better. C) the consumer can rank all affordable consumption bundles. D) all preferences conditions are met.

Suppose the marginal cost of dating Perry is $30 and the marginal benefit is worth $40 to you. Following economic reasoning, you should:

A. determine what your sunk costs are. B. date Perry. C. not date Perry. D. determine what your total benefits and total costs are.