Supply-side tax cuts tend to benefit the rich because tax cuts

A. on income tend to benefit high-income earners more than low-income earners.

B. on savings benefit high-income earners who do most of the personal saving.

C. for capital formation tend to benefit those with the means to accumulate capital.

D. on capital gains tend to benefit those with larger financial assets.

E. All of the above are correct.

Answer: E

You might also like to view...

Supply-side economics

A) promotes increasing taxes to create additional revenue for government spending. B) promotes expansionary fiscal policy by increasing government spending. C) is based on the Ricardian equivalence theorem. D) promotes reducing taxes to create incentives to increase productivity.

Whenever statements embodying values are made, we enter the realm of

A) positive economics. B) normative economics. C) microeconomics. D) macroeconomics.

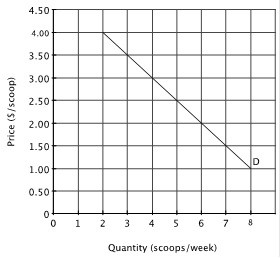

The figure below shows a single consumer's demand for ice cream at the student union.  An increase in the number of students on this campus would cause:

An increase in the number of students on this campus would cause:

A. the market demand curve for ice cream from the student union to shift to the right. B. the demand curve shown above to shift to the right. C. the demand curve shown above to shift to the left. D. no change in the market demand curve for ice cream from the student union.

When a nation's international borrowing is positive, then its national saving ________ its national investment.

A) exceeds B) equals C) is less than