A new bank has reserves of $600,000, checkable deposits of $500,000, and government securities of $100,000. If the desired reserve ratio is 10 percent, the amount of loans this bank can make is

A) $60,000. B) $550,000. C) $50,000. D) $600,000. E) $540,000.

B

You might also like to view...

The exchange rate is volatile because

A) the demand curve and the supply curve are horizontal. B) when a relevant factor changes, demand and supply tend to change in opposite directions. C) the demand curve is vertical. D) the supply curve is vertical. E) when a relevant factor changes, demand and supply tend to change in the same direction.

Lenders generally want a higher interest rate to compensate them when loans stretch over a longer period because:

A. lenders want to be compensated for being unable to get their money back quickly. B. the opportunity cost increases over time. C. there's more uncertainty about potential future investment opportunities. D. All of these are true.

Which two types of goods are rival in consumption?

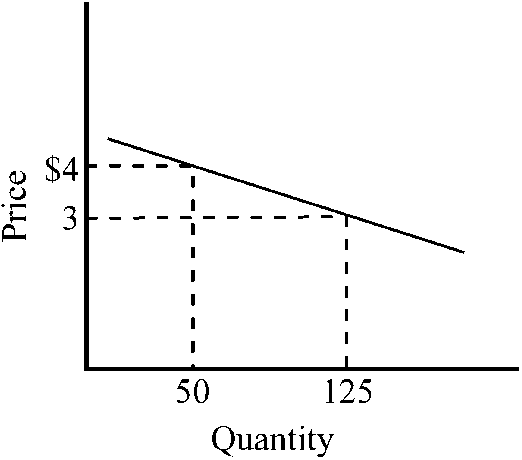

Figure 7-7

In the price range between $3 and $4, the price elasticity of the demand curve depicted in is

a.

highly elastic.

b.

approximately equal to -0.33.

c.

approximately equal to -3.

d.

of unitary elasticity.