Does a state sales tax function as a progressive, regressive, or proportional source of revenue, and why?

What will be an ideal response?

A regressive tax system is one in which tax rates fall as incomes rise. A state sales tax is typically a fixed percentage of certain purchases, but individuals with lower incomes spend a larger portion of their income on items that are sales taxed. As incomes rise, a smaller portion of income is spent on these items, and therefore a lower percentage is allocated to sales tax. As a result, a state sales tax functions as a regressive tax.

You might also like to view...

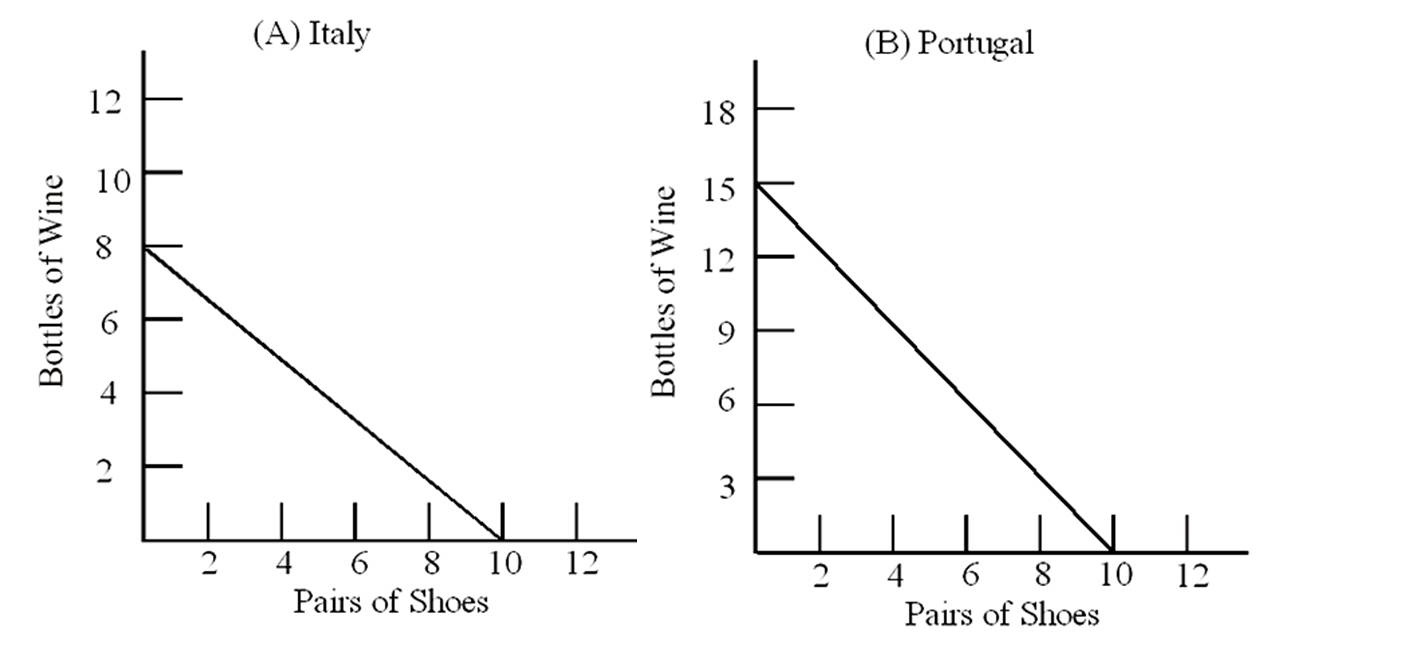

What is the Portugal's opportunity cost of producing 3 bottles of wine?

The extended least squares assumptions are of interest, because

A) they will often hold in practice. B) if they hold, then OLS is consistent. C) they allow you to study additional theoretical properties of OLS. D) if they hold, we can no longer calculate confidence intervals.

A market maker faces the following demand and supply for widgets. Eleven buyers are willing to buy at the following prices: $15, $14, $13, $12, $11, $10, $9, $8, $7, $6, $5 . Eleven sellers are also willing to sell at the same prices. How many transactions must the market maker make if he wants to maximize his profits?

a. 1 b. 2 c. 3 d. 4

Derek has $1 to spend at the grocery store. An apple, an orange, and a banana cost $0.50 each. If Derek's MUA/PA (ratio of marginal utility to price) of an apple is 45, MUO/PO of an orange is 38, and MUB/PB of a banana is 52, he will purchase a(n) _____ first and a(n) _____ second

a. apple; orange b. orange; apple c. banana; orange d. banana; apple e. orange; banana