Suppose there are three power-generating plants, each of which has access to 5 different production processes. The table below summarizes the cost of each production process and the corresponding number of tons of smoke emitted each. Process(smoke/day) A(4 tons/day) B(3 tons/day) C(2 tons/day) D(1 ton/day) E(0 tons/day) Cost to Firm X ($/day) $500$514$530$555$585 Cost to Firm Y ($/day) $400$420$445$480 $520Cost to Firm z ($/day) $300$325$360$400 $550The least costly way of lowering smoke emissions from 12 tons to 9 tons per day would be for:

A. Firm X to emit 1 ton, Firm Y to emit 4 tons and Firm Z to emit 4 tons.

B. each firm to reduce emissions by 1 ton, emitting 3 tons each.

C. Firm X to emit 2 tons, Firm Y to emit 3 tons and Firm Z to emit 4 tons.

D. Firm X to emit 4 tons, Firm Y to emit 3 tons and Firm Z to emit 2 tons.

Answer: C

You might also like to view...

Measuring total production by valuing items at their market value allows us to

A) separate the value of different goods with identical prices. B) separate the value of different goods with different prices. C) add together the value of different goods that have different prices. D) add together the value of identical goods that have identical prices. E) ignore the problem that goods and services differ in how long they last.

Gross domestic product does not measure

A) the sum of the value added by producers at each stage of the production process. B) the total income received by producers for the services they supply. C) the total purchases of newly-produced final goods. D) the total welfare of the noninstitutional population.

During the twentieth century, the real income of the average American grew by a factor of more than seven

a. True b. False Indicate whether the statement is true or false

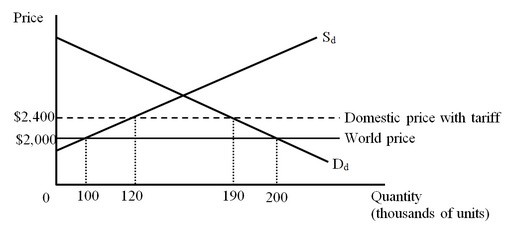

The figure below shows the market for computers in a small importing country. Dd and Sd are the domestic demand and supply curves of computers, respectively. Calculate the tariff revenue of the country's government.

Calculate the tariff revenue of the country's government.

A. $76 million B. $28 million C. $40 million D. $400,000