Which scenario below would lead to lower profits as we double the inputs used by the firm?

A) Increasing returns to scale with constant input prices

B) Constant returns to scale with constant input prices

C) Constant returns to scale with rising input prices (perhaps because the firm is not a price-taker in the input markets)

D) all of the above

C

You might also like to view...

The GDP deflator in year 2 is 105, using year 1 as the base year. This means that, on average, the cost of goods and services is

A) 5% higher in year 2 than in year 1. B) 105% higher in year 1 than in year 2. C) 105% higher in year 2 than in year 1. D) 5% higher in year 1 than in year 2.

A country with a lower relative cost of production of a particular good has a(n) _______ advantage and it is likely to _______ this good.

A) absolute; import B) comparative; import C) comparative; export D) absolute; not export

A disadvantage of corporations over a proprietorship or partnership is in the

A. legal liability. B. taxation system. C. future of the firm when an owner dies. D. ability to raise funds.

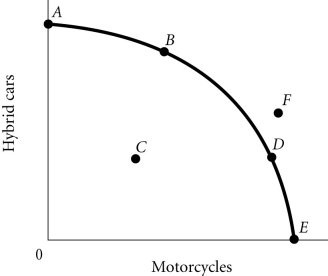

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4Refer to Figure 2.4. The economy moves from Point E to Point B. This could be explained by

Figure 2.4Refer to Figure 2.4. The economy moves from Point E to Point B. This could be explained by

A. a change in society's preferences for hybrid cars versus motorcycles. B. an increase in economic growth. C. an increase in unemployment. D. a reduction in unemployment.