If the Fed wants to discourage commercial bank lending, it will:

A. increase the interest paid on reserves held at the Fed.

B. decrease the interest paid on reserves held at the Fed.

C. buy government securities from commercial banks.

D. lower the federal funds rate target.

A. increase the interest paid on reserves held at the Fed.

You might also like to view...

Assume that the term structure effect and the default-risk premium remain unchanged and that households and firms have adaptive expectations

At the beginning of 2013, a bank is offering car loans at a nominal interest rate of 7% and the expected rate of inflation is 2 %, and at the beginning of 2014, the bank decreases the nominal interest rate to 5%. The real interest rate at the beginning of 2014 is A) 2%. B) 3%. C) 5%. D) This cannot be determined without being given the expected inflation rate for 2014.

Which situation is most likely to exhibit diminishing marginal returns to labor?

A) a factory that obtains a new machine for every new worker hired B) a factory that hires more workers and never increases the amount of machinery C) a factory that increases the amount of machinery and holds the number of worker constant D) None of these situations will result in diminishing marginal returns to labor.

Among arguments for and against advertising, both sides agree that advertising leads to

a. higher prices and less competitive markets. b. higher prices and more competitive markets. c. lower prices and more competitive markets. d. None of the above is correct. The debate fails to resolve the question of advertising's effect on prices and competition.

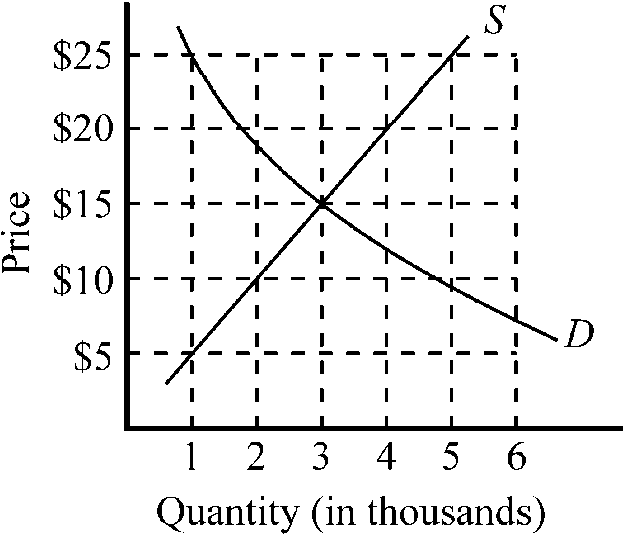

Figure 4-1

illustrates the market for compact discs. If the government imposes a price floor of $25 for compact discs, which of the following will be true?

a.

Consumers would wish to purchase 1,000 compact discs.

b.

Producers would wish to sell 5,000 compact discs.

c.

There would be a surplus of 4,000 compact discs.

d.

All of the above are true.