An income tax hike

A) increases potential GDP.

B) increases employment.

C) decreases potential GDP.

D) Both answers A and B are correct.

E) Both answers B and C are correct.

C

You might also like to view...

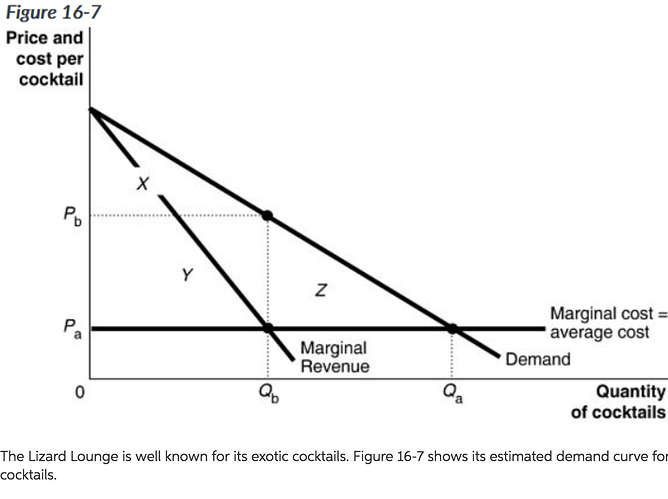

Refer to Figure 16-7. The owners of the Lizard Lounge are considering the following four pricing options:

a. A single price scheme where the cocktail price equals the monopoly price.

b. A single price scheme where the cocktail price equals the competitive price.

c. A two-part tariff: a monopoly cocktail price and a cover charge that will generate total revenue equal to the area X.

d. A two-part tariff: a competitive cocktail price and whatever cover charge that will generate a total revenue equivalent to the area X + Y + Z.

Which pricing scheme(s) achieve the economically efficient outcome?

A) schemes a and c B) scheme b C) schemes b and d D) scheme d only

Refer to Figure 28-9. A supply shock, such as rising oil prices, would be depicted as a movement from

A) C to E to B. B) C to D to A. C) C to B to A. D) A to B to C. E) A to D to C.

Exports from and imports to the U.S. were important to growth in the U.S. between 1790 and 1860 because

(a) exports to other countries expanded the market base for U.S. manufacturing goods. (b) they supported the U.S. economy during a time in which it used more agricultural goods and crude materials than it produced. (c) they helped the U.S. and its trading partners gain wealth through international trade of those goods and services in which each produced at a comparative advantage. (d) they contributed to all of the above.

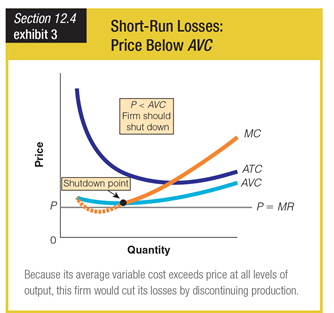

Which of the following would most likely prevent the firm from shutting down?

a. the AVC curve moving further above P

b. the ATC curve moving partly below P

c. the ATC curve moving further above P

d. the AVC curve moving completely below P