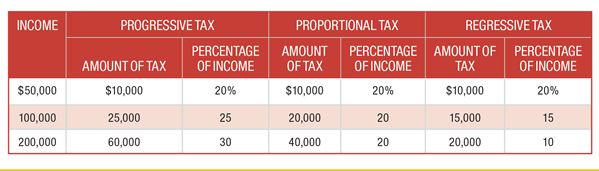

Gabriela earns $50,000 per year. Based on the table demonstrating three tax systems, how would a regressive tax affect her compared to the other two systems?

a. She would pay more than proportional and less than progressive.

b. She would pay more than progressive or proportional.

c. She would pay the same as progressive and proportional.

d. She would pay less than progressive or proportional.

c. She would pay the same as progressive and proportional.

You might also like to view...

In the market for French wines, an increase in demand is illustrated by:

A) a movement up the demand curve. B) a movement down the demand curve. C) a shift of the demand curve to the left. D) a shift of the demand curve to the right.

Examples of incentive pay include

a. allowing employees a certain number of personal days b. providing onsite parking for employees c. bonuses for meeting deadlines d. offering a certain number of sick days

The slope of the consumption function is equal to the marginal propensity to save (MPS)

a. True b. False Indicate whether the statement is true or false

Insufficient capital formation can limit a poor nation's economic growth.

Answer the following statement true (T) or false (F)