A firm's implicit costs are

a. its maintenance costs

b. its paid-out costs of production

c. its main source of executive costs

d. irrelevant to the determination of economic profit

e. opportunity costs of production that do not involve money outlays

E

You might also like to view...

If the working age population ________ and the labor force does not change, the ________

A) increases; labor force participation rate will increase B) increases; labor force participation rate will decrease C) increases; unemployment rate will increase D) decreases; unemployment rate will increase E) decreases; labor force will increase

The U.S. income tax system is progressive

a. True b. False Indicate whether the statement is true or false

Maurice faces a progressive federal income tax structure that has the following marginal tax rates: 0 percent on the first $10,000 . 10 percent on the next $10,000 . 15 percent on the next $10,000 . 25 percent on the next $10,000 . and 50 percent on all additional income. In addition, he must pay 5 percent of his income in state income tax and 15.3 percent of his labor income in federal payroll taxes. Maurice earns $60,000 per year in salary and another $10,000 per year in non-labor income. What is his average tax rate?

a. 17.19 percent b. 46.69 percent c. 48.87 percent d. 56.01 percent

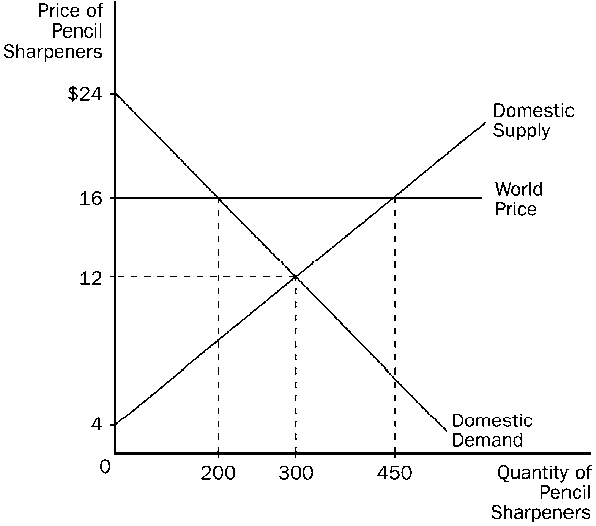

Refer to Figure 17-6 The domestic country is China.

Refer to Figure 17-6 With trade, China will

a. import 100 pencil sharpeners.

b. import 250 pencil sharpeners.

c. export 150 pencil sharpeners.

d. export 250 pencil sharpeners.