If a business is regulated under a statute, federal officials have the right to enter the business at any time to conduct inspections as needed to allow proper enforcement of the law

a. True

b. False

Indicate whether the statement is true or false

False

You might also like to view...

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant paid $3,600 on accounts payable. Which of the following statements is incorrect?

A. Gant's current ratio will increase. B. Gant's quick ratio will increase and its current ratio will decrease. C. Gant's quick ratio will increase. D. Gant's working capital will remain the same.

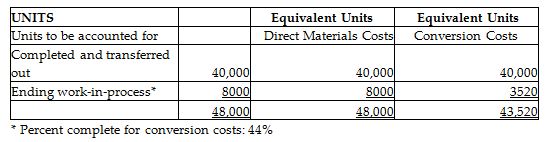

Pestiferous Manufacturing produces a chemical pesticide and uses process costing. There are three processing departments—Mixing, Refining, and Packaging. On January 1, the first department—Mixing—had no beginning inventory. During January, 48,000 fl. oz. of chemicals were started in production. Of these, 40,000 fl. oz. were completed, and 8000 fl. oz. remained in process. In the Mixing Department, all direct materials are added at the beginning of the production process, and conversion costs are applied evenly throughout the process.

At the end of January, the equivalent unit data for the Mixing Department were as follows:

In addition to the above, the cost per equivalent unit were $1.35 for direct materials and $5.30 for conversion costs. Using this data, calculate the full cost of the ending WIP balance in the Mixing Department. The weighted-average method is used.

A) $43,520

B) $10,800

C) $29,456

D) $64,800

In response to corporate abuse by Enron and other corporations, Congress enacted the ______________Act of 2002 that establishedthe Public Company Accounting Oversight Board, which requires registration of auditors of public companies and imposes

regulations regarding accounting methods and financial disclosures. Fill in the blanks with correct word

In governmental accounting, emphasis is placed on:

A. Expenditures of funds. B. The flow of funds through the income statement. C. Generating income from funds employed. D. Total assets owned by the governmental entity.