Given a real interest rate, a decrease in taxes on saving ________ the after-tax real interest rate and ________ the incentive to save

A) increases; increases

B) increases; reduces

C) decreases; increases

D) decreases; reduces

A

You might also like to view...

Answer the following statement(s) true (T) or false (F)

1. Social welfare would be increased if a monopolistically competitive industry were replaced with a competitive industry. 2. The Robinson-Patman Act was designed to stop resale price maintenance. 3. It is possible for a firm engaging in predatory pricing to make a profit on the good even thought the price is set artificially low. 4. It is possible to avoid the prisoners' dilemma as long as the interaction is repeated and has a definite ending date. 5. Fair trade refers to the fact that retailers are free to set their price in the absence of resale price maintenance.

The cultural hypothesis of economic growth claims that:

A) most of the ancient cultures of the world have almost been forgotten post-globalization. B) different values and cultural beliefs cause differences in prosperity around the world. C) a common global culture is automatically created through liberal trade practices. D) values and cultural beliefs are proximate causes for differences in prosperity around the world.

Suppose that you expect during the next year the dollar will appreciate against the pound from 0.5 pound to the dollar to 0.75 pound to the dollar

How much will you expect to make on an investment of $10,000 in British government securities that will mature in one year and pay interest of 8%? A) -59.5% B) -28% C) 8% D) 28%

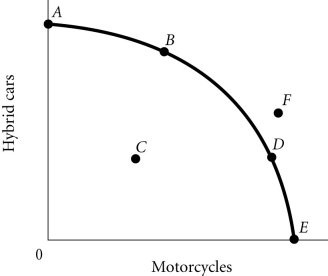

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, Point E necessarily represents

Figure 2.4According to Figure 2.4, Point E necessarily represents

A. only motorcycles being produced. B. overallocation of resources. C. an impossible production point. D. technological advancement.