Which of the following is correct?

A. real interest rate = nominal interest rate / anticipated inflation rate

B. real interest rate = nominal interest rate - anticipated inflation rate

C. real interest rate = nominal interest rate * anticipated inflation rate

D. real interest rate = nominal interest rate + anticipated inflation rate

Answer: B

You might also like to view...

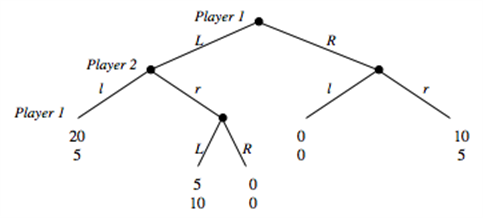

Consider the game depicted below. Player 1 decides between going L or R in stage 1 and 3 of the game. Player 2 decides between going l and r in stage 2 of the game.

c. Identify the subgame perfect equilibrium strategies and outcome. d. Identify the Nash Equilibria that are not subgame perfect. e. For each Nash Equilibrium that is not subgame perfect, explain which parts of the Nash Equilibrium strategies are non-credible. f. Suppose you have developed a drug that can be administered without the victim being aware of it. The effect of the drug is that the victim suddenly becomes gullible and believes anything he is told. You only have 1 dose of the drug and decide to auction it off to the two players right before they play each other in the game you have analyzed so far. Each player is asked to submit a sealed bid, and the highest bidder will be sold the drug at a price equal to the highest bid. In case of a tie in bids, a coin is flipped to determine who wins and pays the price that was bid. Suppose in this part that payoffs are in terms of dollars and that bids can be made in one cent increments. Suppose further that players do not consider bidding above the maximum they are willing to pay. Given that the players know each other's payoffs in the above game, what is the equilibrium price that you will be able to sell the drug for? (Hint: There are two possible answers.) g. In part (f), we said "Suppose further that players do not consider bidding above the maximum they are willing to pay." Can you think of a Nash equilibrium to the auction that would end in a price of $8 if we had not made that statement in (f)? What will be an ideal response?

If people assume that future rates of inflation will ________, they are said to have adaptive expectations

A) not be related to inflation rates of the past B) follow the pattern of inflation rates in the past C) be higher than inflation rates of the past D) be lower than inflation rates of the past

According to classical macroeconomic theory, changes in the money supply affect

a. real GDP and the price level. b. real GDP but not the price level. c. the price level, but not real GDP. d. neither the price level nor real GDP.

The rapid growth of the temporary-help industry

A. could decrease the natural rate of unemployment. B. has not affected the unemployment rate since part-time workers are counted as fully employed. C. has enabled employers to fill job vacancies more easily. D. All of the choices are correct.