Forward commitment by the Fed has which of the following impacts?

A. Forward commitment encourages lending because banks do not fear that the Fed will

suddenly reverse the policy.

B. Forward commitment encourages excessive lending as banks try to take control of as

many reserves as possible before the policy is exhausted.

C. Forward commitment eliminates all flexibility in monetary policy.

D. Forward commitment creates moral hazard in lending, as banks know that the Fed will

continue to pump reserves into the system.

A. Forward commitment encourages lending because banks do not fear that the Fed will

suddenly reverse the policy.

You might also like to view...

A price support set above the equilibrium price does which of the following?

i. decreases producer surplus ii. decreases consumer surplus iii. decreases the marginal cost of the last unit produced A) i and ii B) i and iii C) ii and iii D) i, ii, and iii E) ii only

Abstract economic theory can be used by academicians but not by politicians or business people.

Answer the following statement true (T) or false (F)

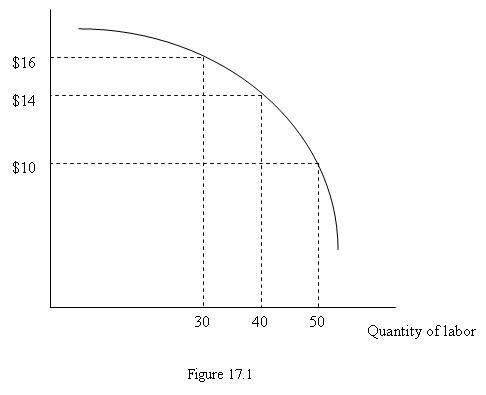

Figure 17.1 depicts a firm's marginal revenue product curve. If the product price is $2, what is the marginal product of the 30th hour of labor?

Figure 17.1 depicts a firm's marginal revenue product curve. If the product price is $2, what is the marginal product of the 30th hour of labor?

A. 5 units B. 6 units C. 7 units D. 8 units

Firms that are earning zero economic profits are

A. shutting down in the short run. B. breaking even. C. earning less than a normal rate of return. D. shutting down in the long run.