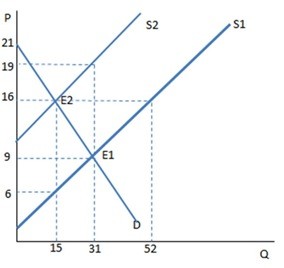

Suppose a tax on sellers has been imposed in the graph shown. The amount of deadweight loss generated by this tax is:

Suppose a tax on sellers has been imposed in the graph shown. The amount of deadweight loss generated by this tax is:

A. $80.

B. $160.

C. $129.50.

D. $0.

Answer: A

You might also like to view...

Starting from long-run equilibrium, a war that raises government purchases results in ________ output in the short run and ________ output in the long run.

A. lower; potential B. higher; potential C. higher; higher D. lower; higher

According to this Application, which of the following is a reason for holding cash?

A) for convenience B) fear of financial catastrophe C) to make a purchase when you cannot use a debit or credit card D) all of the above

With ________ finance, borrowers obtain funds from lenders by selling them securities in the financial markets

A) active B) determined C) indirect D) direct

A tax of $1 on buyers shifts the demand curve downward by exactly $1

a. True b. False Indicate whether the statement is true or false