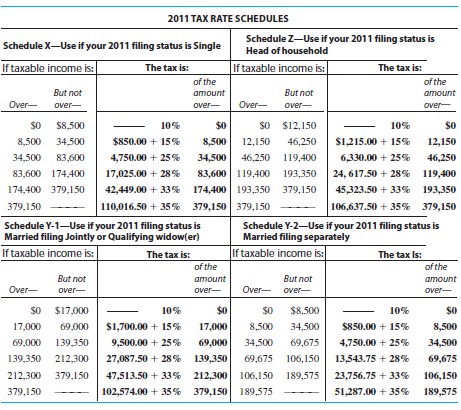

Find the tax. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the tax rate schedule.  Jennifer Binh is single and claims one exemption. Her salary last year was $93,074, and she had other income of $6256 and interest income of $8353. She has adjustment to income of $2486 for an IRA contribution. Her itemized deductions are $4122 in mortgage interest, $2408 in state income tax, $1586 in real estate taxes, and $806 in charitable contributions.

Jennifer Binh is single and claims one exemption. Her salary last year was $93,074, and she had other income of $6256 and interest income of $8353. She has adjustment to income of $2486 for an IRA contribution. Her itemized deductions are $4122 in mortgage interest, $2408 in state income tax, $1586 in real estate taxes, and $806 in charitable contributions.

A. $19,268.75

B. $19,538.00

C. $20,412.16

D. $22,036.16

Answer: B

Mathematics

You might also like to view...

Analyze the graph and write the equation of the function it represents in standard form f(x) = a(x - h)2 + k.

A. f(x) = (x + 3)2 B. f(x) = -(x + 3)2 C. f(x) = (x - 3)2 D. f(x) = -(x - 3)2

Mathematics

Divide.553 ÷ 39.5

A. 1.4 B. 14.0 C. 140 D. 15

Mathematics

Divide by using long division.

A. 635 R128 B. 635 R258 C. 635 D. 258

Mathematics

The lengths of the legs of a right triangle are given. Find the hypotenuse.a = 20, b = 48

A. 20 B. 32 C. 48 D. 52

Mathematics