The data for the U.S. show that investment and profits

A) have a strong negative relationship.

B) are positively related during recessions, and negatively related during expansions.

C) move independently.

D) are positively related during expansions, and negatively related during recessions.

E) none of the above

E

You might also like to view...

In the modern Keynesian model, over much of its range the short-run aggregate supply (SRAS) curve is

A) horizontal. B) vertical. C) upward sloping. D) downward sloping.

Between 1970 and 2000, if the Fed had tried to hit the money growth targets:

A. the interest rates would have likely been more stable. B. the federal funds rate would have changed often and by large amounts. C. the economy would have likely experienced very high inflation. D. the economy would have likely experienced very high inflation but the interest rates would have likely been more stable.

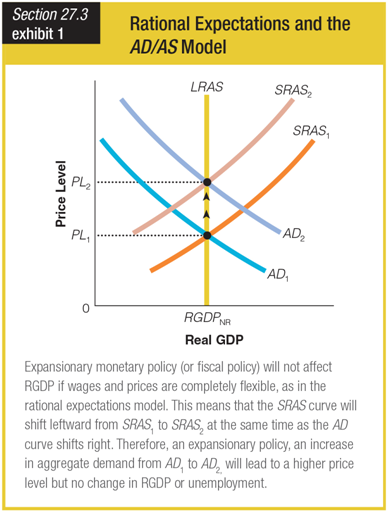

Based on the graph showing rational expectations and the AD/AS model, how do shifts in the short-run aggregate supply and aggregate demand curves influence RGDP?

a. Since both curves move to the left, RGDP decreases.

b. Since both curves move to the right, RGDP increases.

c. Since the curves move equally in opposite directions, RGDP does not change.

d. Since both curves become vertical, RGDP becomes zero.

The Case in Point on the Simpsons indicated that even fictional characters face:

A) diminishing marginal product. B) opportunity costs. C) the fallacy of false cause. D) positive statements.