What happens to desired investment spending if the interest rate rises? Is this response relevant to the supply of loanable funds curve or the demand for loanable funds curve?

Investment spending falls. This relationship is relevant to the demand for loanable funds.

You might also like to view...

Nominal gross domestic product (GDP) is measured in terms of the _____

a. current-year prices b. base-year prices c. export of goods and services d. amount of taxes collected e. hours of employment

Demand-pull inflationary pressure increases as the economy approaches full employment

a. True b. False Indicate whether the statement is true or false

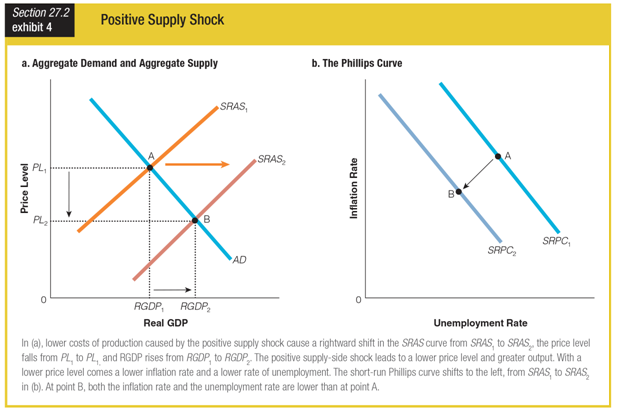

By looking at the graphs showing the impact of a positive supply shock on aggregate demand and aggregate supply and on the Phillips curve, we can see that a positive supply shock would ______.

a. increase price levels and RGDP, but decrease inflation rates and unemployment rates

b. increase price levels, RGDP, inflation rates, and unemployment rates

c. decrease price levels, RGDP, inflation rates, and unemployment rates

d. decrease price levels, inflation rates, and unemployment rates, but increase RGDP

Considering the concept of cross-price elasticity, if two goods are substitutes:

A. an increase in the price of one causes an increase in the demand for the other. B. an increase in the price of one causes a decrease in the demand for the other. C. the cross-price elasticity is negative. D. a decrease in the price of one causes an increase in the demand of the other.