How were countries whose industries competed with Chinese industry affected by a yuan that was pegged to the dollar?

A) Because the yuan was undervalued at the pegged exchange rate, the level of Chinese exports remained higher than they would have been if the exchange rate was allowed to float freely.

B) Competitors feared that the declining value of the dollar would continue to make Chinese goods more expensive.

C) Because the yuan was overvalued at the pegged exchange rate, competing firms from other countries feared that abandoning the peg would lead to an increase in Chinese exports.

D) Because China's population is so large relative to other countries, the pegged exchange rate made the goods of foreign competing firms much less expensive than domestic Chinese goods.

A

You might also like to view...

When the price of an asset is growing rapidly, speculators:

A. usually look for other investment opportunities. B. have a strong incentive to sell the asset before its price gets even higher. C. often rush to buy the asset in the hopes of selling it later at a profit. D. typically refrain from buying the asset because they know its price will eventually fall.

Using the above figure, which of the following quantities of CDs has the largest deadweight loss?

A) 3 million CDs B) 4 million CDs C) 7 million CDs D) The deadweight losses associated with the three quantities given above are all equal.

When marginal tax rates are constant,

A. the change in taxes paid is the same as the change in income. B. the change in taxes paid is greater than the change in income. C. the change in taxes paid is less than the change in income. D. there are no taxes. E. none of these answer options are correct.

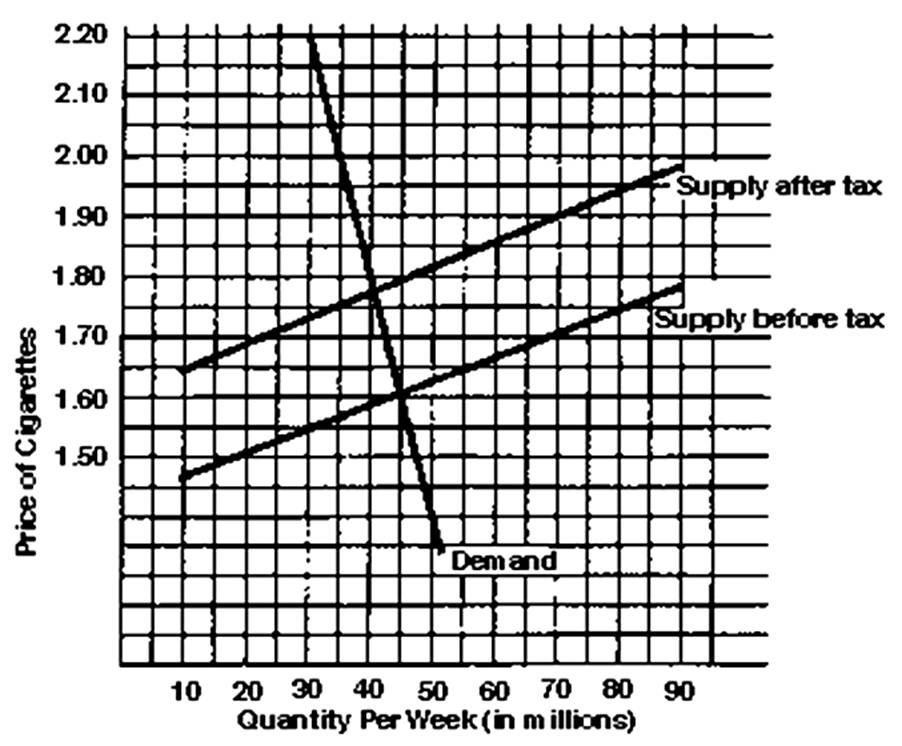

How much revenue will the government raise each week from the tax?

A. $8 million

B. $10 million

C. $20 million

D. $40 million