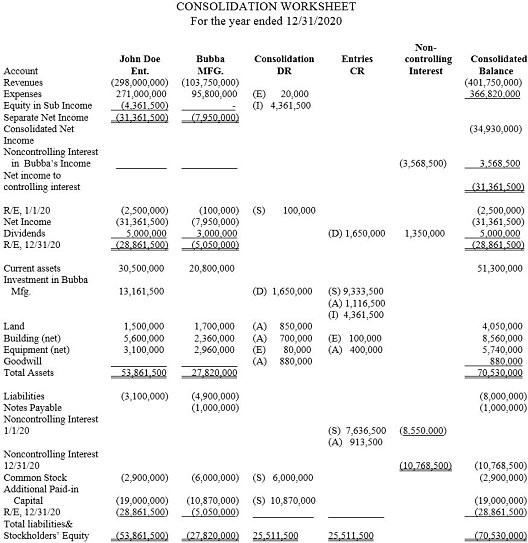

On January 1, 2020, John Doe Enterprises (JDE) acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2020. Book Value Fair ValueLand$1,700,000 $2,550,000 Buildings (seven-year remaining life) 2,700,000 3,400,000 Equipment (five-year remaining life) 3,700,000 3,300,000 ??For internal reporting purposes, JDE employed the equity method to account for

this investment. ?The following account balances are for the year ending December 31, 2020 for both companies.? John Doe Enterprises Bubba ManufacturingRevenues$(298,000,000) $(103,750,000)Expenses 271,000,000 95,800,000 Equity in income of Bubba Manufacturing (4,361,500) 0 Net income$(31,361,500) $(7,950,000)Retained earnings, January 1, 2020$(2,500,000) $(100,000)Net income (above) (31,361,500) (7,950,000)Dividends paid 5,000,000) 3,000,000)Retained earnings, December 31, 2020$(28,861,500) $(5,050,000)Current assets$30,500,000 $20,800,000 Investment in Bubba Manufacturing 13,161,500 0 Land 1,500,000 1,700,000 Buildings 5,600,000 2,360,000 Equipment (net) 3,100,000 2,960,000 Total assets$53,861,500 $27,820,000 Accounts payable$(3,100,000) $(4,900,000)Notes payable 0 (1,000,000)Common stock (2,900,000) (6,000,000)Additional paid-in capital (19,000,000) (10,870,000)Retained earnings, December 31, 2020 (above) (28,861,500) (5,050,000)Total liabilities and stockholders' equity$(53,861,500) $(27,820,000)?Required:?Prepare a consolidation worksheet for this business combination. Assume goodwill has been reviewed and there is no goodwill impairment.

What will be an ideal response?

You might also like to view...

The simplest way to enter a foreign market is through ________

A) joint venturing B) direct investment C) exporting D) joint ownership E) contract manufacturing

The trading area with the highest average purchase by a customer is the _____

a. parasite b. primary trading area c. secondary trading area d. fringe trading area

Which of the following is a role of the marketing plan?

A. convincing skeptical investors that your plan has merit B. identifying the target market for the organization C. detailing the advertising plan D. All of these.

The president of a company says that new products to be introduced are sure to double company profits. Based on this, investors buy stock in the company, pushing up its price. The products flop, the company loses money, so the stock price falls. Investors are most likely to sue the president of the company under what theory provided by the securities law?

a. liability for mismanagement b. liability for insider trading c. liability for misstatements d. liability for securities negligence e. none of the other choices; there is no basis for a lawsuit here