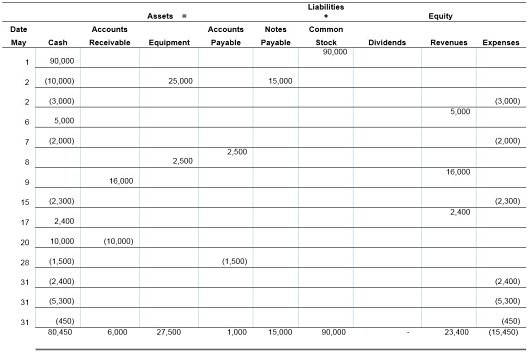

Verity Siding Company, whose sole stockholder is S. Verity, began operations in May and completed the following transactions during that first month of operations. Show the effects of the transactions on the accounts of the accounting equation by recording increases and decreases in the appropriate columns in the table below. Do not determine new account balances after each transaction. Determine the final total for each account and verify that the equation is in balance.May 1S. Verity invested $90,000 cash in the company in exchange for commonstock.?2The company purchased $25,000 in office equipment. It paid $10,000 in cash and signed a note payable promising to pay the $15,000 over the nextthree years.?2The company rented office space and paid $3,000 for the May rent.?6The

company installed new vinyl siding for a customer and immediately collected $5,000.?7The company paid a supplier $2,000 for siding materials used on the May6 job.?8The company purchased a $2,500 copy machine for office use on credit.?9The company completed work for additional customers on credit in the amount of $16,000.?15The company paid its employees' salaries $2,300 for the first half of the month.?17The company installed new siding for a customer and immediately collected $2,400.?20The company received $10,000 in payments from the customers billed onMay 9.?28The company paid $1,500 on the copy machine purchased on May 8. It will pay the remaining balance in June.?31The company paid its employees' salaries $2,400 for the second half of the month.?31The company paid a supplier $5,300 for siding materials used on the remaining jobs completed during May.?31The company paid $450 for this month's utility bill.

What will be an ideal response?

You might also like to view...

Use the following information to answer the question below. The following accounts appear in the ledger of Pepper Corporation on December 31, 20x5 Preferred Stock $60,000 Common Stock 116,000 Additional Paid-in Capital, Preferred 14,000 Additional Paid-in Capital, Common 36,000 Retained Earnings 80,000 A balance sheet prepared on December 31, 20x5 , would report total contributed capital of

A) $176,000. B) $190,000. C) $226,000. D) $306,000.

In a double-entry accounting system, total debits must equal total credits for all entries, and total debit account balances in the ledger must equal total credit account balances.

Answer the following statement true (T) or false (F)

In the Milgram study of 1963, what proportion of volunteers would have obeyed the instruction to “kill” the subject?

a. 12% b. 65% c. 25% d. 40%

Steel Rolling Corp, purchased a mine, which holds an estimated 38,000 tons of iron ore, on January 1, 2017, for $538,000

The mine is expected to have zero residual value. The business extracted and sold 15,500 tons of ore in 2017 and 8,800 tons of ore in 2018. What is the depletion expense for 2017? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) A) $124,608 B) $219,480 C) $86,608 D) $318,600