Behavioral economists view the standard economic theory of decisions involving time as being too restrictive because people:

A. have lapses in self-control.

B. make systematic errors in forecasting the future.

C. are reluctant to abandon projects after incurring substantial sunk costs, despite low probabilities of success.

D. All of these describe reasons why the standard economic theory of decisions over time can be too restrictive.

You might also like to view...

Assuming money neutrality in the classical model, a 10% increase in the nominal money supply would cause

A) a 10% increase in the real money supply. B) a 10% decrease in the real money supply. C) no change in the real money supply. D) a less-than-10% change in the price level due to a shift in the aggregate supply curve.

Which measurement is most useful for comparing the standard of living in different countries?

A. The growth rate of real GDP. B. GDP per capita. C. GDP per worker. D. The growth rate of the labor force.

Increases in net investment generally result in:

A. lower levels of capital stock and lower levels of depreciation. B. lower levels of capital stock and higher levels of depreciation. C. higher levels of capital stock and higher levels of depreciation. D. higher levels of capital stock and lower levels of depreciation.

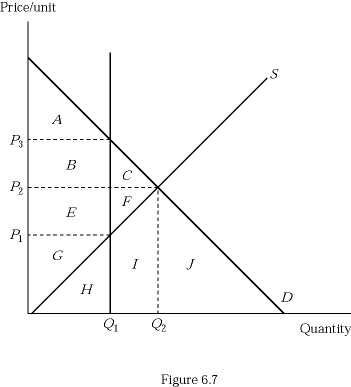

In Figure 6.7 with a quantity constraint of Q1, consumer surplus is area:

In Figure 6.7 with a quantity constraint of Q1, consumer surplus is area:

A. A. B. A + B + C. C. E + F + G. D. B+E+G.