A mechanism for reallocating risk is:

A. risk premiums.

B. dividend pooling.

C. diversification.

D. All of these are mechanisms for reallocating risk.

C. diversification.

You might also like to view...

What are some of the potential obstacles that can lead to market failure by preventing a market from reaching the efficient outcome? Briefly define each obstacle

What will be an ideal response?

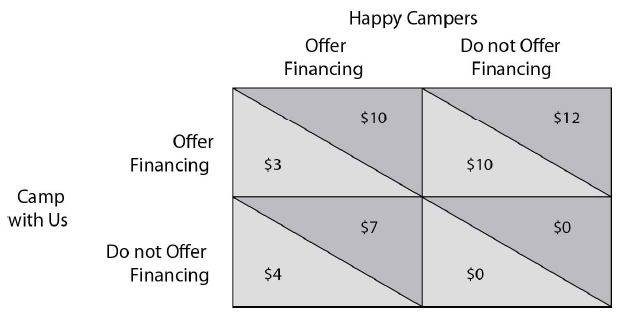

Refer to the payoff matrix below. Which is the equilibrium of the game using the Pareto criterion?

Camp with Us and Happy Campers compete in the market for campers. Each firm must decide each season if they are going to offer special financing or not. The above payoff matrix shows each firm's net economic profit at each pair of strategies.

A) Camp with Us Offer Financing and Happy Campers Do Not Offer Financing

B) Camp with Us Offer Financing and Happy Campers Offer Financing

C) Camp with Us Do Not Offer Financing and Happy Campers Do Not Offer Financing

D) Camp with Us Do Not Offer Financing and Happy Campers Offer Financing

Which of the following statement is true?

a. The demand for Cheerios is less elastic than the demand for cereal b. The demand for gas is more elastic in the short-run than in the long-r c. The demand for puma shoes is more elastic than the demand for shoes d. Products with many complements have a more elastic demand

A price ceiling keeps a price:

a. from rising above a certain level. b. from decreasing below a certain level. c. at a stabilized point. d. from increasing or decreasing.