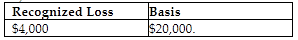

Chana purchased 400 shares of Tronco Corporation stock for $40,000 in 2014. On December 27, 2018, Chana sells the 400 shares for $24,000. Chana purchases 300 shares of Tronco Corporation stock on January 16, 2019 for $8,000. Chana's recognized loss on sale of the 400 shares in 2018 and her basis in her 300 new shares are

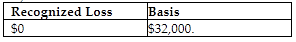

A)

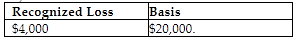

B)

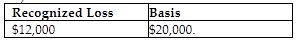

C)

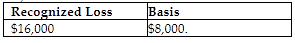

D)

B)

The realized loss on the 400 shares is $16,000 ($24,000 - $40,000). $16,000 × 300/400 = $12,000 is disallowed due to the wash sale. $16,000 - $12,000 = $4,000 allowed loss in 2018. The basis of the new shares is the $8,000 cost plus the $12,000 unrecognized loss = $20,000 basis in new stock.

You might also like to view...

Higher the riskiness of a borrower, higher is the premium charged above the prime rate by a banker

Indicate whether the statement is true or false

Legally, a partnership must

A. have at least one limited partner. B. have at least one general partner. C. make all owners general partners. D. not have any general partners. E. designate a limited partner to be responsible for all debts of the partnership.

A breakdown of the fees and expenses of a mutual fund is not one of the items addressed in a prospectus

Indicate whether the statement is true or false.

If you lose the bank card you use to withdraw cash from your bank by machine, and you report it to the bank within two days, you are liable for how much in losses?

a. $0 b. $500 c. $5,000 d. however much is in your account e. none of the other choices