Beans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics:Number of units in the job10Total direct labor-hours50Direct materials$920Direct labor cost$1,400If the company marks up its unit product costs by 40% then the selling price for a unit in Job K818 is closest to: (Round your intermediate calculations to 2 decimal places.)

A. $363.30

B. $383.30

C. $324.80

D. $103.80

Answer: A

You might also like to view...

Qualitative research involves collecting, analyzing, and interpreting data by observing what people do and say

Indicate whether the statement is true or false

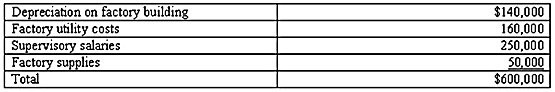

Parr Corporation makes three products, X, Y, and Z. Expected overhead costs for the coming year include: Parr uses direct labor hours as the cost driver to allocate overhead costs. Budgeted direct labor hours for each product are:Product X, 15,000 direct labor hoursProduct Y, 10,000 direct labor hoursProduct Z, 5,000 direct labor hoursRequired:1) Determine the amount of manufacturing overhead that should be allocated to each of the three products.2) Assume that each unit of Product X requires $40 in direct materials and 3 direct labor hours at a rate of $15 per hour. Calculate the budgeted or expected cost of each unit of X.

Parr uses direct labor hours as the cost driver to allocate overhead costs. Budgeted direct labor hours for each product are:Product X, 15,000 direct labor hoursProduct Y, 10,000 direct labor hoursProduct Z, 5,000 direct labor hoursRequired:1) Determine the amount of manufacturing overhead that should be allocated to each of the three products.2) Assume that each unit of Product X requires $40 in direct materials and 3 direct labor hours at a rate of $15 per hour. Calculate the budgeted or expected cost of each unit of X.

What will be an ideal response?

Which of the following is NOT a major cause of personal bankruptcy?

A) divorce B) illness and medical problems C) job loss or income reduction D) financial mismanagement E) all of the above are major causes of personal bankruptcy

On November 1, Jasper Company loaned another company $100,000 at a 6.0% interest rate. The note receivable plus interest will not be collected until March 1 of the following year. The company's annual accounting period ends on December 31, and adjustments are only made at year-end. The adjusting entry needed on December 31 is:

A. Debit Interest Receivable, $1,000; credit Interest Revenue, $1,000. B. Debit Interest Receivable, $500; credit Interest Revenue, $500. C. Debit Interest Expense, $1,000; credit Note Payable, $1,000. D. No entry required. E. Debit Interest Expense, $5,000; credit Interest Payable, $5,000.