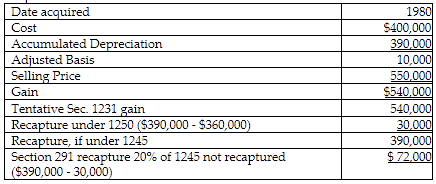

In 1980, Artima Corporation purchased an office building for $400,000 for use in its business. The building is sold during the current year for $550,000. Total depreciation allowed for the building was $390,000; straight-line would have been $360,000. As result of the sale, how much Sec. 1231 gain will Artima Corporation report?

A) $150,000

B) $398,000

C) $510,000

D) $540,000

B) $398,000

1231 gain: $500,000 gain - $30,000 (1250 recapture) - $72,000 (291) = $398,000

You might also like to view...

Which of the following is not a critical element in a total quality management system?

a. employee involvement b. activity-based costing c. continuous improvement d. problem prevention emphasis

Which sentence is expressed correctly?

A) Todays college students don't know what life is like without technology. B) Today's college students don't know what life is like without technology. C) Todays' college students don't know what life is like without technology.

Match the following steps in Microsoft's development of Windows 8 to their respective WBS level

Step Level Develop Windows 8 Operating System ? System Testing ? Compatible with Windows 7 ? Develop GUI's ? Module Testing ? A) Level 1, Level 2, Level 4, Level 3, Level 3 B) Level 1, Level 2, Level 3, Level 4, Level 5 C) Level 0, Level 1, Level 2, Level 3, Level 4 D) Level 0, Level 2, Level 2, Level 3, Level 3 E) Level 5, Level 3, Level 4, Level 1, Level 2

Five weeks in the semester you have completed 0% of your project management class under the 0/100 rule

Indicate whether the statement is true or false