Real interest rates have, at times, been negative. Why would anyone lending money agree to a negative real interest rate?

What will be an ideal response?

The lender did not agree to a negative real interest rate, but unanticipated inflation occurred. If the actual inflation rate exceeds the anticipated inflation rate, the actual real interest rate received by lenders and paid by borrowers can end up negative.

You might also like to view...

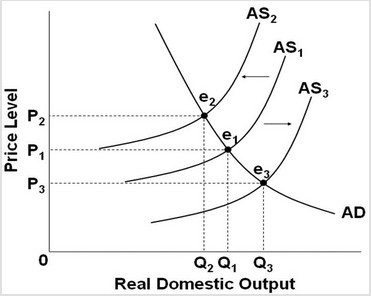

Use the following graph to answer the next question. If current output is Q1 and full-employment output is Q3, then in the long run the short aggregate supply schedule is ________.

If current output is Q1 and full-employment output is Q3, then in the long run the short aggregate supply schedule is ________.

A. AS1 B. AD C. AS3 D. AS2

In the above figure, the shift in the demand curve from D to D1 can be the result of

A) a decrease in income if pizza is a normal good. B) a decrease in the price of a sub sandwich, a substitute for pizza. C) an increase in the price of soda, a complement to pizza. D) an increase in the number of teenagers, all of whom demand more pizza than do other age groups. E) new technology that increases the profit from producing pizza.

If the interest rate increased, which of the following would occur?

a. Nothing would occur. b. The consumption-income line would shift downward. c. The consumption-income line would shifts upward. d. There would be an rightward movement along the consumption-income line. e. There would be a leftward movement along the consumption-income line.

Since price tends to equal marginal utility, the price of water is low and the price of diamonds is high

a. True b. False Indicate whether the statement is true or false