For Federal income tax purposes, a distribution from a partnership to a partner is treated the same as a distribution from a C corporation to its shareholders

a. True

b. False

Indicate whether the statement is true or false

False

RATIONALE: A distribution from a partnership to a partner is a tax-deferred transaction which generally results in no current taxable income. A distribution from a C corporation to its shareholders is taxed as a dividend to the extent of the corporation's earnings and profits (E & P).

You might also like to view...

Which of the following is an example of liquidity analysis?

a. Bonds payable are divided by total liabilities and stockholders' equity. b. Net income is divided by total assets. c. Net income is divided by the number of shares of stock outstanding d. Current assets are divided by current liabilities.

Financial statement analysis is a judgmental process

Indicate whether the statement is true or false

Bumgardner Inc. has provided the following data concerning one of the products in its standard cost system.InputsStandard Quantity or Hours per Unit of OutputStandard Price or RateDirect materials8.0 liters$5.00 per liter?The company has reported the following actual results for the product for April: Actual output 7,400unitsRaw materials purchased 65,400litersActual price of raw materials$5.70per literRaw materials used in production 59,210liters?The direct materials purchases variance is computed when the materials are purchased.?The raw materials price variance for the month is closest to:

A. $41,447 F B. $45,780 U C. $41,447 U D. $45,780 F

What was the amount of net cash provided by (used for) investing activities?

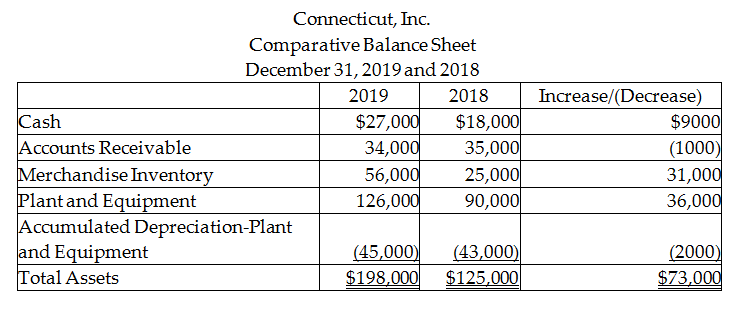

Connecticut, Inc. uses the indirect method to prepare its statement of cash flows. Refer to the following portion of the comparative balance sheet:

Additional information provided by the company includes the following:

1. Equipment was purchased for $69,000 with cash.

2. Equipment with a cost of $33,000 and accumulated depreciation of $7300 was sold for $46,000.

A) $188,000

B) $23,000

C) $(188,000)

D) $(23,000)