During normal times, if the marginal propensity to consumer is 3/4, and the government borrows $10 billion in order to increase spending by that amount, real output will expand by

a. more than $40 billion, because both the additional borrowing and the additional spending will stimulate real output.

b. $40 billion, because the net multiplier will be 4.

c. less than $40 billion, because the additional borrowing will place upward pressure on real interest rates, weakening the impact of the multiplier.

d. $10 billion, because during normal times, the government can borrow funds without any increase in interest rates.

C

You might also like to view...

Countries that have high rates of savings also have

A) high rates of investment. B) low rates of investment. C) stock market bubbles. D) low rates of growth. E) no international trade.

IBM and Sara Lee are two of the biggest firms in the United States, but they produce different products. Could they legally merge, or would their merger be struck down by the courts?

Ben's nominal annual income in 2009 was $40,000. If the rate of inflation is constant at 10 percent, in order to keep Ben's real income constant, his nominal income in the year 2010 should be:

A. $50,000. B. $44,000. C. $40,000. D. $36,000.

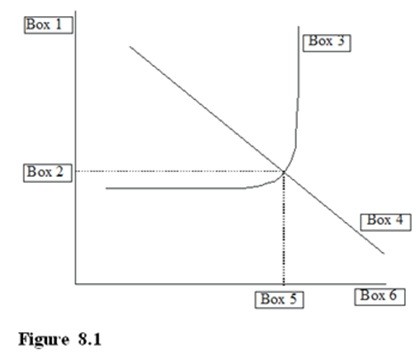

Referring to the Aggregate Demand - Aggregate Supply diagram in Figure 8.1, which box should be filled with the label AS for the aggregate supply curve?

A. Box 1 B. Box 2 C. Box 3 D. Box 4