Assume that the government increases spending and finances the expenditures by borrowing in the domestic capital markets. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the real GDP and current international transactions in the context of the Three-Sector-Model?

a. Real GDP falls, and current international transactions become more negative (or less positive).

b. Real GDP rises, and current international transactions become more negative (or less positive).

c. Real GDP and current international transactions remain the same.

d. Real GDP rises, and current international transactions remains the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.B

You might also like to view...

If the GDP of Macroland is $250,000,000 and they have a population of 5,000 people, then the GDP per capita is:

A. quite high. B. $5,000. C. $1,250,000. D. $50,000.

Which of the following is the best example of an investment in human capital?

a. on-the-job training received by an apprentice electrician b. an increase in the number of hours worked per week by a worker in an unskilled laboring job c. the purchase of company stock by a worker d. payments into a retirement pension plan by a skilled laborer

An indifference curve illustrates the prices facing a consumer as she chooses how much X and how much Y to consume.

A. True B. False

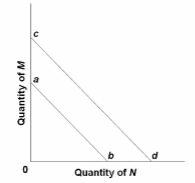

The budget line shift from ab to cd in the figure is consistent with:

A. decreases in the prices of both M and N.

B. an increase in the price of M and a decrease in the price of N.

C. a decrease in money income.

D. an increase in money income and decrease in the price of N.