If the Fed decides to control the euro/dollar exchange rate:

A. they will have to control the domestic rate of inflation or it won't work.

B. they will also have to control the domestic interest rate.

C. they will have to control the amount of banking system reserves.

D. the market will determine the interest rate.

Answer: D

You might also like to view...

A likely consequence of debt default is: a. a decrease in the federal cost of borrowing

b. an increase in unemployment due to growing uncertainty. c. a sudden decline in the market interest rates. d. an increase in the credit flows in an economy. e. a sudden increase in the investment flows in the economy.

The fact that U.S. national security depends upon what other nations spend on their national security means that

a. the U.S. may end up with less national security even if it devotes more resources to national security b. the U.S. should devote fewer resources to national security c. the U.S. should devote even more resources to national security than it considers desirable d. the U.S. can never be secure e. peace is an impossible dream

Federal Reserve Notes are

A. the currency part of the United States money supply. B. United States government securities owned by the Fed. C. the backing for all bank account balances. D. used exclusively by the government to pay off its debt.

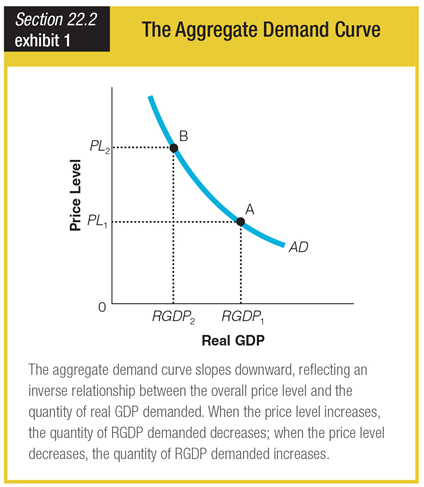

If the price level changes from PL2 to PL1, what happens to the quantity of real GDP demanded?

a. It decreases from RGDP2 to RGDP1.

b. It increases from RGDP1 to RGDP2.

c. It decreases from RGDP1 to RGDP2.

d. It increases from RGDP2 to RGDP1.