Appreciation of the dollar refers to

A. An increase in the dollar price of foreign currency.

B. A fall in the dollar price of a foreign currency.

C. Intervention in international money markets.

D. A loss of foreign exchange reserves.

Answer: B

You might also like to view...

Answer the following statement(s) true (T) or false (F)

1. Speculators will sell futures contracts when they believe future demand will be lower than suppliers expect. 2. Diversification tends to raise the standard deviation of a portfolio. 3. Risk-averse investors choose to hold only two assets: a risk-free asset and a market portfolio 4. When faced with two portfolios that offer the same expected return, a risk-averse investor prefers the one with the higher standard deviation. 5. There is only one possible market portfolio-the portfolio consisting of all the risky assets in the economy.

Fluctuating exchange rates can alter a multinational firm's profits and losses. German company Bayer produces products in Germany and sells them in the United States

If the dollar depreciates against the euro, then Bayer's sales in the United States should ________ because it will take ________ U.S. dollars to purchase the German-made products. A) fall; more B) fall; fewer C) rise; more D) rise; fewer

Which of the following statements accurately describes the two measures of the money supply?

A) The two measures do not move together, so they cannot be used interchangeably by policymakers. B) The two measures' movements closely parallel each other, even on a month-to-month basis. C) Short-run movements in the money supply are extremely reliable. D) M2 is the narrowest measure the Fed reports.

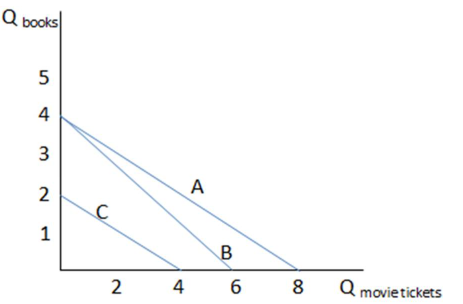

Assume Claudia's budget constraint is demonstrated by line A in the graph shown. Which of the following would cause Claudia's budget constraint to shift to line C?

A. Claudia's income increased.

B. Claudia's income decreased.

C. Claudia's preferences for these two goods decreased.

D. The prices of both goods have gone down.