Under the indirect method, if a current liability account increases from the beginning of the year to the end of the year, what is the impact of the change on the statement of cash flows?

a. Cash inflow from financing

activities is increased; b. Cash inflow from financing activities is decreased; c. Cash inflow from operating activities is increased; d. Cash inflow from operating activities is decreased; e. none of these.

C

You might also like to view...

If the price per unit is $34 and the variable cost per customer is $17, calculate the margin per unit

A) $2 B) $51 C) $25.5 D) $8.5 E) $17

In December 2016, a donor to a college established a trust in which college receives $5,000,000 to be invested. The donor's spouse is to receive $40,000 of the income per year for ten years. At that point, the assets and income revert to the college. The college estimates that the present value of the anticipated receipts from the trust amount to $4,800,000. How should this $4,800,000 be recorded in 2016, assuming The College is aprivate institutionThe College is apublic institutionA)Contribution revenueDeferred inflowB)Contribution revenueContribution revenueC)Deferred inflowDeferred inflowD)Deferred inflowContribution revenue

A. A) B. B) C. C) D. D)

The measure of damages awarded to an innocent party for fraud is the difference between the value of the property as represented and the actual value of the property.

Answer the following statement true (T) or false (F)

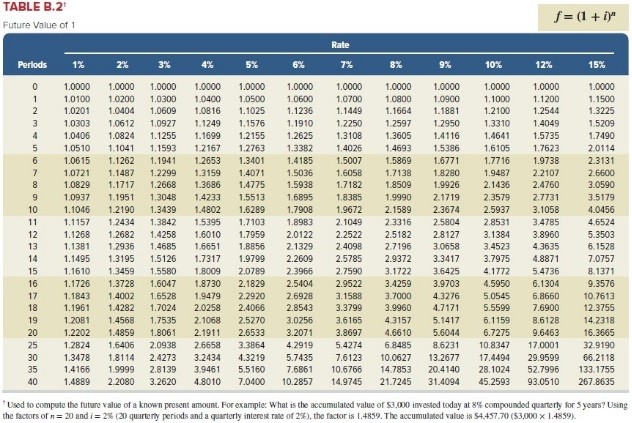

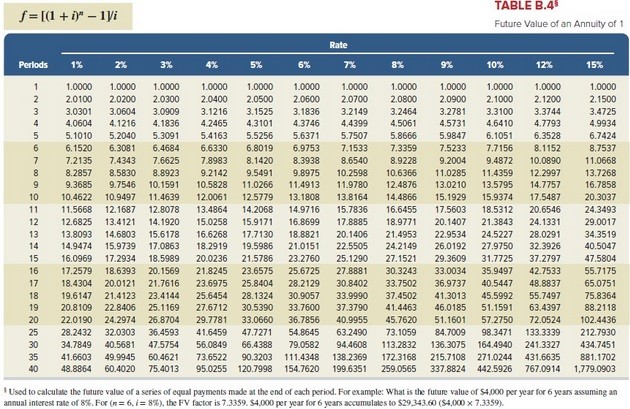

Clara is setting up a retirement fund, and she plans on depositing $5400 per year in an investment that will pay 6% annual interest. How long will it take her to reach her retirement goal of $71,176? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use

Clara is setting up a retirement fund, and she plans on depositing $5400 per year in an investment that will pay 6% annual interest. How long will it take her to reach her retirement goal of $71,176? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use

appropriate factor(s) from the tables provided.) A. 0.076 years B. 10 years C. 5.0 years D. 13.18 years E. 20 years