Explain how a change in the interest rate on reserves affects the money supply.

What will be an ideal response?

An increase in the interest rate on reserves will strengthen the incentive for banks to save their reserves and decrease the excess reserves held by commercial banks, thus causing the money supply to decrease. A decrease in the interest rate on reserves will encourage banks to make loans, thus causing the money supply to increase.

You might also like to view...

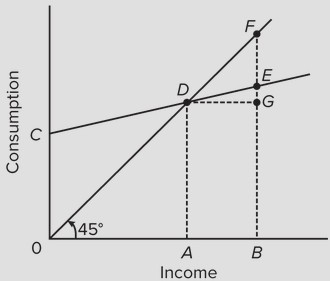

Use the following consumption schedule to answer the next question.  The marginal propensity to consume is represented by

The marginal propensity to consume is represented by

A. GE/AB. B. EF/BE. C. GF/BE. D. DE/AB.

In the figure above, the poorest 40 percent of all households receive what share of income?

A) 10 percent B) 20 percent C) 40 percent D) 60 percent

If the equilibrium exchange rate exceeds the par exchange rate in the market for pounds, the pound is overvalued

Indicate whether the statement is true or false

The demand curve for the output of a perfectly competitive firm is

a. perfectly inelastic. b. perfectly elastic. c. a rectangular hyperbola with an elasticity equal to 1. d. identical in shape to the market demand curve.