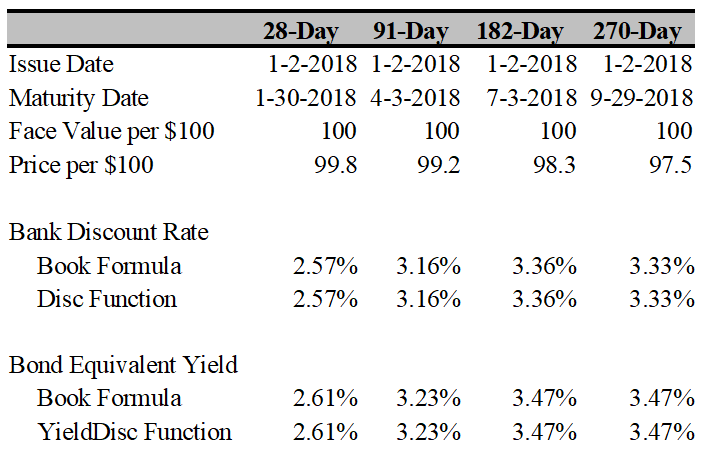

Suppose that on January 2, 2018, the U.S. Treasury auctioned the following four T-Bills:

a) Determine the bank discount rate for each T-Bill using formula 10-3 given in the chapter and the DISC function.

b) Determine the bond equivalent yield for each T-Bill using the formulas given in the chapter and the YIELDDISC function.

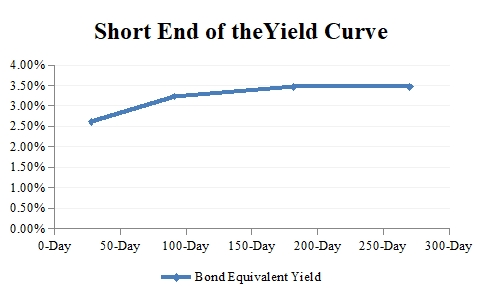

c)Create a chart of a portion of the yield curve using the results of the bond equivalent yield in part b.

You might also like to view...

During 2010, Heckart Corporation had sales of $250,000, net income of $25,000, average total assets of $350,000, dividend payments of $17,500, net cash flows from operating activities of $43,000, purchases of plant assets of $37,500, and sales of plant assets of $45,000 . Cash flows to sales equals (Round amounts to one decimal place)

a. 12.3 percent. b. 14.3 percent. c. 21.5 percent. d. 17.2 percent.

The current portion of long-term debt should

A) be classified as a long-term liability. B) not be separated from the long-term portion of debt. C) be paid immediately. D) be reclassified as a current liability.

A bill of exchange is an unconditional written order

Indicate whether the statement is true or false

In a mediation

A) the parties to the dispute attempt to their own agreement. B) the decision of a third party such as a judge is binding. C) the decision of a third party such as a judge is non-binding. D) the decision of a third party such as a judge can be binding or non-binding.