Sabrina Duncan had gross earnings for the pay period ending 10/15/19 of $5,785. Her total gross earnings as of 9/30/19 were $116,400. If Social Security taxes are 6.2% on a maximum earnings of $122,700 per year, Sabrina's Social Security withheld from her 10/15/19 paycheck would be:

A. $220.47

B. $358.67

C. $390.60

D. $216.07

Answer: B

You might also like to view...

Describe the challenges associated with the regulatory approach to environmental concerns.

What will be an ideal response?

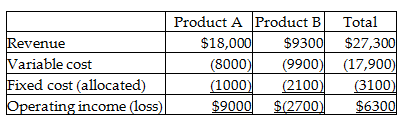

Assume that fixed costs are all unavoidable and that dropping one product would not impact sales of the other. If Product B is dropped, what would be the impact on total operating income of the company?

A company has two different products that are sold in different markets. Financial data are as follows:

A) increases by $2100

B) increases by $600

C) decreases by $2100

D) decreases by $600

Marco Manufacturing contracted to sell Kurtz Industries 3,000 iron clasps. The contract specified: F.O.B. Kurtz Industries. Upon arrival and inspection, the goods were rejected by Kurtz Industries because they did not conform to the contract specifications. In transit back to Marco Manufacturing, the common carrier's truck overturned and completely destroyed the clasps. Which statement is correct?

A. Marco may sue Kurtz for the contract price, as risk of loss transferred to Kurtz at the F.O.B. point. B. Kurtz will not be liable for the purchase price. The risk of loss had not yet transferred since the goods were nonconforming. C. The loss will be split between the parties on a 50/50 basis. D. The loss will be assigned to the party who can best bear the loss.

______ are drafts that mature on the payment date set in the future

a. Time or term drafts b. Delayed drafts c. Lapsed drafts d. Real estate drafts e. none of the other choices are correct