The yield to maturity is equal to

A) the interest rate at which the present value of an asset's returns is equal to its price today.

B) the face value or par value of a coupon bond.

C) any payments received from an asset at the date the asset matures.

D) interest rate on the asset minus any taxes owed on the interest received.

A

You might also like to view...

The concept of "economic pessimism" stems from

A) the theory and empirical fact which states that developing nations face declining export prices relative to increasing import prices. B) the fact that economic growth in an era of globalization is difficult to attain. C) the fact that smaller countries would not enjoy comparative advantage unless they are allowed to subsidize some of their industries. D) the fact that it is impossible to achieve desired economic development without adopting full democratic principles. E) None of the above.

Refer to the information below. If the firms' managers form a price -fixing cartel that maximizes the firms' total profit, what is the total economic profit made by all firms?

A small nation has three gasoline suppliers with a linear monthly market demand equal to: Q = 500,000 - 5P. Each firm's marginal cost (MC) and average total cost (ATC) curves are horizontal at $10,000 per month. A) 3,375,000,000 B) $10,125,000,000 C) $575,000,000 D) $54,000,000

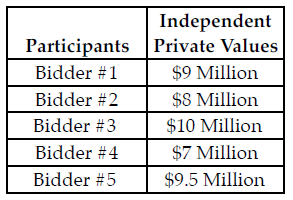

Refer to the table below. Recall that the bidders only know their own private value of the item and they do not know the other participants' private values. Further, assume each participant will submit bids using their optimal strategy. If the participants are bidding in a Dutch auction, Bidder ________ wins the auction and pays ________.

The table above lists the independent private values of five participants in an auction. Each of the bidders only knows their own value and does not know the private values of the other participants.

A) #3; a value less than $10 million and greater than $9.5 million

B) #5; a value less than $10 million and greater than $9.5 million

C) #5; 9.5 million

D) #3; $10 million

Suppose that a new drug has been approved to treat a life-threatening disease. The demand for that drug is shown on the graph below. Prior to approval of this drug, the only treatment for this condition was any one of several non-prescription, or over-the-counter, pain relievers. The demand for one brand of the several non-prescription pain relievers is also shown on the graph.  A likely reason for the difference in the slopes of the demand curves is that:

A likely reason for the difference in the slopes of the demand curves is that:

A. one market is in equilibrium and the other is not. B. the over-the-counter pain reliever has many substitutes, but the new drug does not. C. one drug is heavily regulated by the Food and Drug Administration and the other is not. D. one drug is new on the market, but the other has been available for a long time.