Employment legislation during the 1930s included which of the following Acts:

A) FLSA, FUTA, and FICA.

B) ADEA, Davis-Bacon Act, and FLSA.

C) Walsh-Healey Act, FICA, and ERISA.

D) FUTA, ADA, and FLSA.

A) FLSA, FUTA, and FICA.

You might also like to view...

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows: Direct materials$17.80 Direct labor 19.00 Variable manufacturing overhead 1.00 Fixed manufacturing overhead 17.10 Unit product cost$ 54.90 An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing

overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 70,000 units required each year? (Round your intermediate calculations to 2 decimal places.) A. $54.90 per unit B. $50.60 per unit C. $58.80 per unit D. $3.90 per unit

Amortization of the premium on bonds payable is subtracted from net income in the reconciliation of net income to cash flows from operations because

a. it is a financing cash outflow. b. it reduces income without causing a cash outflow. c. interest expense understates the cash paid for interest by the amount of the premium amortization. d. it increases income without causing a cash flow. e. None of these answers is correct.

A recent study by Deloitte and the Billie Jean King Leadership Initiative shows that Millennials, in general, see the concepts of diversity and inclusion as very different. What are the implications for a company in terms of culture and innovation?

What will be an ideal response?

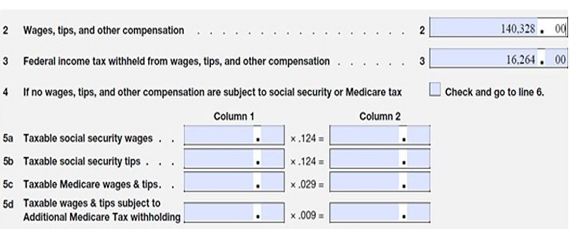

McBean Farms has the following information on their Form 941:

What amount should be entered in Column 2, Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base.)

A) $17,400.67 and $4,069.51, respectively

B) $140,328.00

C) $8,700.34 and $2,034.76, respectively

D) $156,592